Vietnam has unveiled its Investment Support Fund (ISF) as a strategic initiative to maintain its competitive edge in attracting multinational corporations (MNCs) amid the implementation of the Global Minimum Tax (GMT) framework. This calculated move is set to bolster Vietnam’s appeal to foreign investors, particularly high-tech enterprises, ensuring its sustained prominence in the global investment landscape.

Navigating the Global Minimum Tax Framework

The GMT, introduced in June 2021 by G7 nations, mandates that MNCs with revenues exceeding €750 million are taxed at a minimum rate of 15% on their global earnings. This measure seeks to curtail tax avoidance by preventing corporations from exploiting low-tax jurisdictions. For Vietnam, whose corporate income tax (CIT) is 20%, the challenge lies in balancing global tax compliance with maintaining a favorable environment for foreign investments.

To address this, the ISF aims to provide additional incentives to offset potential drawbacks for MNCs operating in Vietnam, especially those whose effective tax rates fall below the GMT threshold due to existing exemptions and preferential policies.

A Strategic Tool for High-Tech Investment

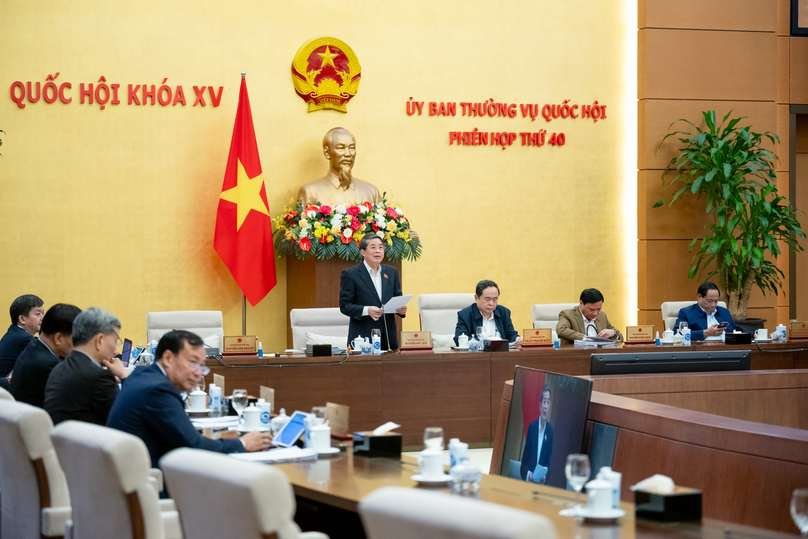

The ISF, approved by the National Assembly Standing Committee, is designed to prioritize high-tech investments and foreign enterprises. Le Quang Manh, head of the National Assembly’s Finance and Budget Committee, emphasized that the fund’s primary beneficiaries would be foreign-invested businesses contributing to Vietnam’s advanced industrial base.

While domestic firms might face barriers in meeting the ISF’s high-tech criteria, this targeted approach ensures that Vietnam retains its competitive edge in sectors that drive innovation and economic growth.

Challenges Facing Vietnam’s Investment Climate

Global corporations such as LG Chemical, AT&S, and SMC have expressed concerns over Vietnam’s current investment support mechanisms, with some delaying or halting new projects. This hesitation underscores the need for Vietnam to adapt its policy framework, as existing income-based incentives like tax exemptions are insufficient in the face of the GMT’s requirements.

Reports from the Ministry of Planning and Investment highlight the urgency of this issue. Without reforms, Vietnam risks losing its attractiveness to high-tech foreign investors, particularly in a competitive regional landscape where other countries may offer more comprehensive support.

Implementation and Oversight

The National Assembly has called for a robust and transparent implementation of the ISF. Key focus areas include:

Support Levels: Defining the scale and scope of assistance to align with the GMT framework.

Inspection Mechanisms: Establishing rigorous systems to monitor fund usage and compliance.

Penalties for Mismanagement: Introducing strict measures to prevent misuse and ensure accountability.

This structured approach aims to solidify investor confidence while fostering a stable and competitive investment environment.

Outlook for Vietnam’s Investment Strategy

The ISF represents a pivotal moment in Vietnam’s economic strategy. By aligning its policies with international tax standards while offering targeted support to high-tech MNCs, Vietnam positions itself as a premier destination for foreign investment. This initiative not only reinforces its commitment to global economic integration but also safeguards its long-term industrial and technological growth.

Conclusion The Investment Support Fund is more than a fiscal adjustment—it is a strategic maneuver designed to secure Vietnam’s place in the evolving global economy. By proactively addressing the challenges posed by the GMT and focusing on high-tech industries, Vietnam signals its intent to remain a key player in the international investment arena.