In response to growing concerns over defaults in Cambodia’s corporate bond market, financial experts are urging investors to adopt a higher risk tolerance while calling for reforms to bolster the legal framework around corporate debt and bankruptcy. The recent rise in bond defaults, particularly in the real estate sector, has prompted a renewed focus on improving market resilience and encouraging investors to take a more calculated approach to high-risk investments.

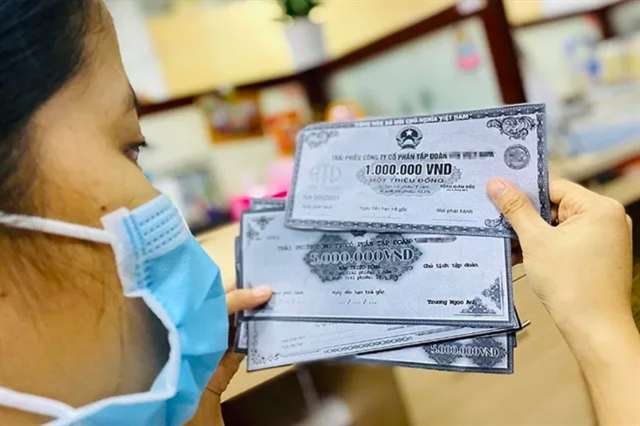

Corporate bonds, which have been a significant source of capital for Cambodia’s burgeoning real estate and infrastructure sectors, are now facing heightened scrutiny as several issuers struggle to meet repayment obligations. Bond issuers have increasingly sought extensions for principal and interest payments, further complicating the financial landscape.

Corporate Defaults and Bond Market Pressure

As of 2024, Cambodia’s bond market is facing a wave of defaults and financial instability, driven largely by the global economic slowdown and sector-specific issues such as declining real estate demand. Bond defaults have increased, and the Hà Nội Stock Exchange (HNX) reported that numerous organizations have requested delays in bond settlements.

For example, Fuji Nutri Food JSC, a notable company in the food sector, recently delayed settling a bond valued at VNĐ998 billion (US$40 million), attributing the delay to financial difficulties. This instance, along with other similar cases, has shaken investor confidence and placed Cambodia’s corporate bond market in a precarious position.

Experts Weigh in on Risk Management

In light of these challenges, financial experts are advocating for a two-pronged approach: improving the legal infrastructure surrounding bankruptcy and encouraging investors to embrace higher risk tolerance in the face of market uncertainty. Dr. Lê Xuân Nghĩa, a leading economist and former vice chairman of the National Financial Supervisory Commission (NFSC), emphasized the need for stronger bankruptcy provisions to mitigate systemic risks in the corporate bond market.

“Corporate defaults are a natural occurrence in any market, but Cambodia’s legal framework is not yet equipped to handle these situations efficiently,” Nghĩa said. “By strengthening bankruptcy legislation, we can create a more stable and predictable investment environment, reducing the fallout from defaults.”

Experts also pointed to the importance of maintaining investor education on the risks involved in bond investments. Cambodia’s financial institutions have been tasked with ensuring that investors, particularly retail investors, understand the inherent risks of high-yield corporate bonds and do not enter the market without fully evaluating the potential for loss.

The Role of the Real Estate Sector

One of the primary drivers of the bond market’s current instability is the real estate sector, which accounts for a significant portion of Cambodia’s corporate bond issuance. As global demand for real estate declines and construction projects stall, many real estate companies have been unable to generate the revenue necessary to meet their bond repayment schedules.

However, experts suggest that the real estate sector is not the only contributor to the bond market’s challenges. The broader economic slowdown, combined with rising inflation and supply chain disruptions, has left several sectors grappling with liquidity issues. As a result, companies in various industries are increasingly turning to debt restructuring and seeking extensions on bond payments.

Strengthening Bankruptcy Laws and Market Confidence

To address these issues, experts are calling for comprehensive reforms to Cambodia’s bankruptcy laws. Currently, the legal process for handling corporate defaults is cumbersome, and there are few protections in place for bondholders. By improving the legal framework, experts believe that Cambodia can reduce the level of uncertainty surrounding bond investments and provide greater security for both institutional and retail investors.

According to Nghĩa, “Strengthening the legal infrastructure around corporate bankruptcy will not only protect investors but also encourage more disciplined borrowing and lending practices. Companies will be more cautious in their debt issuance, knowing that there are clear consequences for defaulting.”

Investor Risk Tolerance: A Key to Market Stability

Beyond legal reforms, experts argue that investor psychology will play a critical role in determining the future of Cambodia’s corporate bond market. For the market to regain stability, investors must be willing to accept the inherent risks of bond investments, particularly in sectors facing economic headwinds.

“Risk is an essential component of investing, especially in emerging markets like Cambodia’s,” said Nghĩa. “Investors need to be aware that the higher the yield, the greater the risk. By fostering a culture of informed risk tolerance, we can maintain market liquidity and continue to attract capital to the corporate bond sector.”

In response, Cambodia’s financial regulators are working to provide more transparency in corporate bond markets, offering better data on bond issuers’ financial health and creditworthiness. These measures aim to help investors make more informed decisions and minimize the potential for future defaults.

Conclusion: Balancing Risk and Reform

Cambodia’s corporate bond market remains a vital component of the country’s broader economic development, providing necessary capital for infrastructure and business growth. However, as the market grapples with rising defaults and financial instability, experts are calling for a balance between regulatory reform and investor risk tolerance.

By improving bankruptcy laws and encouraging more prudent investment strategies, Cambodia’s financial authorities hope to stabilize the bond market and provide a more secure environment for future investment. In the meantime, investors are urged to remain vigilant and informed, recognizing both the opportunities and the risks inherent in Cambodia’s corporate bond landscape.